Example Spanish Vat Number

User is trying to give the VAT ID for a spain customer as ESJ41725920 and the sytem says the VAT registration number is invalid. 28 rows VAT number format VAT in local languages Enquiry letter.

Vat In China Explained What Is A Fapiao Chinese Invoice

Domestic supply of goods not reverse charged.

Example spanish vat number. More over this VAT registration number. The first 2 digits indicate the province where you. Spain applies a standard VAT rate of 21 and two reduced VAT rates.

Once the registration has been approved a Spanish VAT number will be issued. VAT number of the non-resident legal unit which controls the legal unit. Please enter Spain VAT Number VAT to check Last checked VAT numbers PL5210088067 PL9372717673 GB354715057 GB751812341 DK34751102 DK25283147 HR75297532041 HR89184716914 PL9930640224 IE4872885V PT299003663 PL1132191233 PL898202541 PL1070036104 PL5252044117.

This will prevent it from obtaining nil VAT on intra-community supplies. Número de iva 17 número iva 3 de iva 2 el número de iva intracomunitario 2 51 VAT number of the transporter. VAT certificate to prove the business is registered for VAT elsewhere in the EU if appropriate.

You might need to change the importing path import esVat from formvalidationdistes6validatorsvatesVat. 11 characters May include alphabetical characters any except O or I as first or second or first and second characters. For more information see our guide to the Spanish NIE number for foreigners as well as our guide to Spanish taxes.

In the EU a VAT identification number can be verified online at the EUs official VIES website. An extract from the companys national trade register. You will need to apply for this number when you start your first job in Spain.

Registration Threshold Distance Selling. This number also serves as a Spanish VAT number. Last ninth digit is a MOD11 checksum digit.

The following are some usual examples of taxable transactions. This number then stays with you for all subsequent jobs. ESW0601104C ESY0041572W The setup in SPRO for Spanish vendors only indicate the lenght of the VAT for Spain but not its composition and it.

To obtain a Spanish VAT number an application must be made in Spanish which requires the following supporting information. Spain VAT ID. If you applied for intracommunitary VAT exemption and your company has been approved then this number will be listed in the EU VAT registry.

If they store goods in Spain or if they are doing distance sales in excess of 35000 Euro. 28 rows A value added tax identification number or VAT identification number VATIN is an identifier used in many countries including the countries of the European Union for value added tax purposes. The Value Added Tax number is an identification number that will enable you to do business and submit your invoices to companies inside Europe.

31 rows EU VAT number formats. 51 Número de IVA del transportista. This is the case for those individuals who without having a physical office in Spain would like to do any kind of economic activity with the country like exporting goods.

35000 EU VAT number format. Who needs a Spanish tax number. Foreign business selling to Spanish customers need a VAT number in Spain in two cases.

In order to do any of these a legal and valid Spanish VAT number is necessary for non-Spanish entities. In this article we focus on the storage of goods in Spain for further. With our VAT registration service once you send us the documents you will receive your Spanish non-resident VAT number in 48 hours.

When i check the same in TCode Oy17 the length of the VAT registration number is 11 and checking rule is 3 and other data is marked. The following supplies are now subject to the reduced rate of 10 in Spain. For example a trader may not have their new Spanish VAT number automatically registered on the VIES system.

If you are self-employed you apply yourself for this number. Examples have not been reviewed. Memorandum and Articles of Association.

Spain being an EU member state falls under the EU VAT regime. Member states must adopt EU VAT Directives into their own legislation. The 10th character is always B.

The hotel services camping and spa services restaurant services and in general the provision of meals and drinks to be consumed on the spot. Const res1 esVat validate B64717838. The following snippet shows how to use the vat validator with ES6 module.

It confirms that the number is currently allocated and can provide the name or other identifying. A non-resident company is required to have a. Res1valid true const res2.

Resident - There is no registration threshold. Getting a VAT number in Spain. However there are a number of types of numbers which have different restrictions.

A supply of goods located in Spain to a Spanish customer where the supply is not subject to reverse charge requires a VAT registration of the supplier. Tax identification numbers in Spain are mandatory for anyone carrying out legal or economic activities in Spain. As a general rule a foreign business must register for VAT in Spain as soon as a taxable supply is made.

Vat Number Check Failed For Valid Spanish Vat Number Starting With Esb Issue 40554 Odoo Odoo Github

How To View Your Vat Certificate In 2020 Mtd Hellotax Blog

Bank Details Invoice Template Best Template Ideas In 2021 Invoice Template Templates Free Design Best Templates

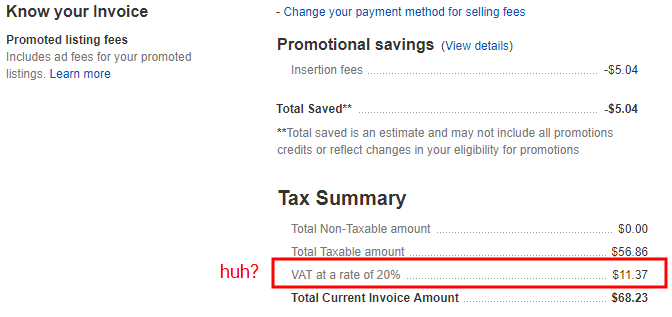

Ebay Vat Fees For International Sellers Eu Uk All Countries

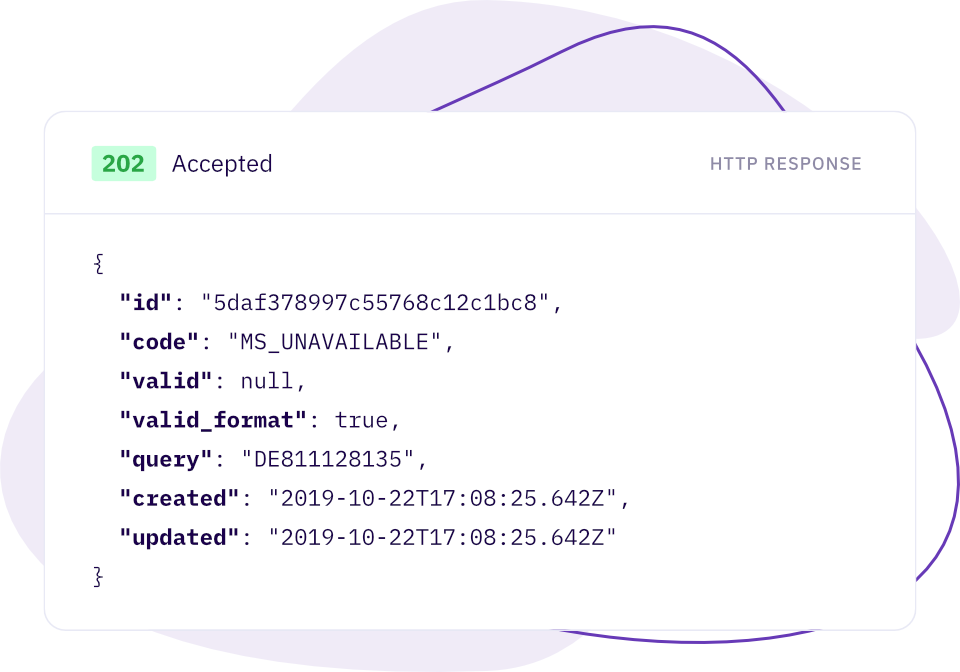

Vat Number Check Api For Business Customers Vatstack

Hansaworld Integrated Erp And Crm

Hansaworld Integrated Erp And Crm

Article Invoice Template Broadband Bills

Uk Tax Invoice Template Invoice Template Invoice Template Word Invoice Sample

10 Tax Invoice Templates Word Excel Pdf Templates Invoice Template Invoice Template Word Microsoft Word Invoice Template

Hansaworld Integrated Erp And Crm

Blank Price Quotation Template In Google Docs Google Sheets Excel Word Apple Numbers Apple Pages Pdf Template Net Quotations Quotation Format Quote Template

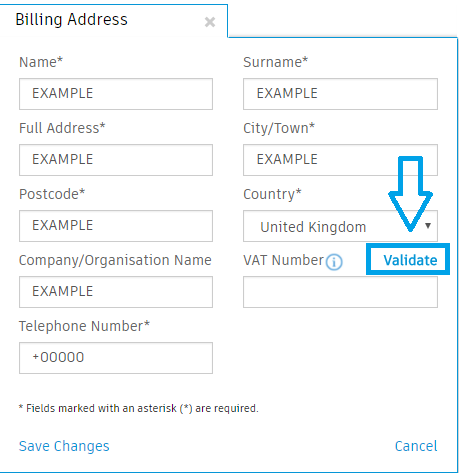

I Am Not Able To Validate The Vat Number During Purchase Search Autodesk Knowledge Network

Sales Invoicing Example For Germany Invoice Template Invoice Example Best Templates

Country Specific Chapter 6 21b

Bank Details Invoice Template Best Template Ideas In 2021 Invoice Template Templates Free Design Indesign

How To Declare Freelancer Vat In Spain Spainguru

Post a Comment for "Example Spanish Vat Number"