Example Of Government Budget Deficit

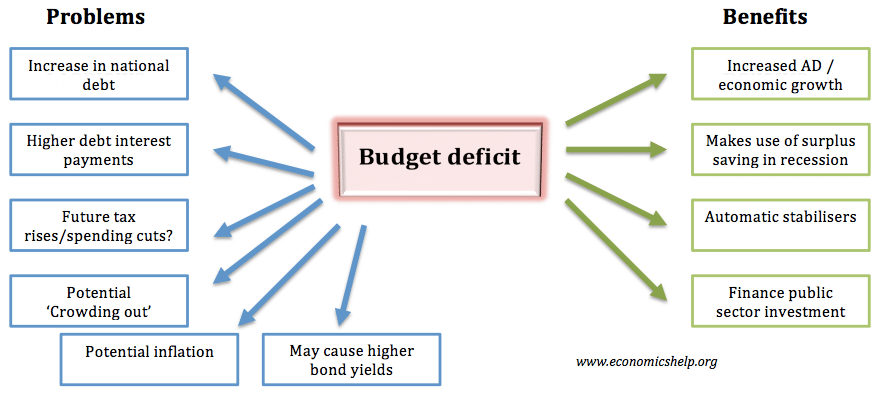

A budget deficit implies lower taxes and increased Government spending G this will increase AD and this may cause higher real GDP and inflation. A budget deficit occurs when expenses exceed revenue and indicate the financial health of a country.

Understanding The Effects Of Fiscal Deficits On An Economy

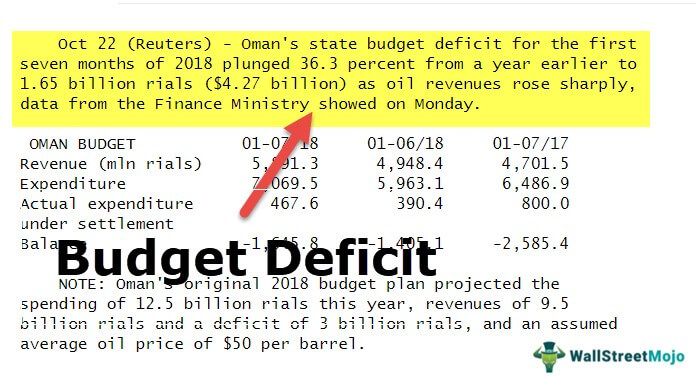

United States Federal Governments total income for the fiscal year 2012 is 2469 trillion while its corresponding expenditures amount to 3796 trillion.

Example of government budget deficit. In other words the amount it spends over and above its income. A budget deficit typically occurs when expenditures exceed revenue. Numerical on Fiscal Deficit with solutions.

So every year tax cuts add to the deficit by reducing revenue. Fund public sector investment. Note- there is no previous year or accumulated borrowing on the government.

Each years deficit adds to the debt. A budget deficit is an indicator of financial health. For example if it receives 2 trillion in tax receipts but spends 25 trillion on public services it has a budget deficit of 500 billion.

That was more than triple the deficit. Depending on the feasibility of these estimates budgets are of three types -- balanced budget surplus budget and deficit budget. What Is a Budget Deficit.

A is a description of income-expenditure of government. This deficit presents a picture of the financial health of the economy. A budget deficit is when spending exceeds income.

Revenue Expenditure 2000 no interest on accumulated borrowing Capital Expenditure 1000. For example the US. For example the US.

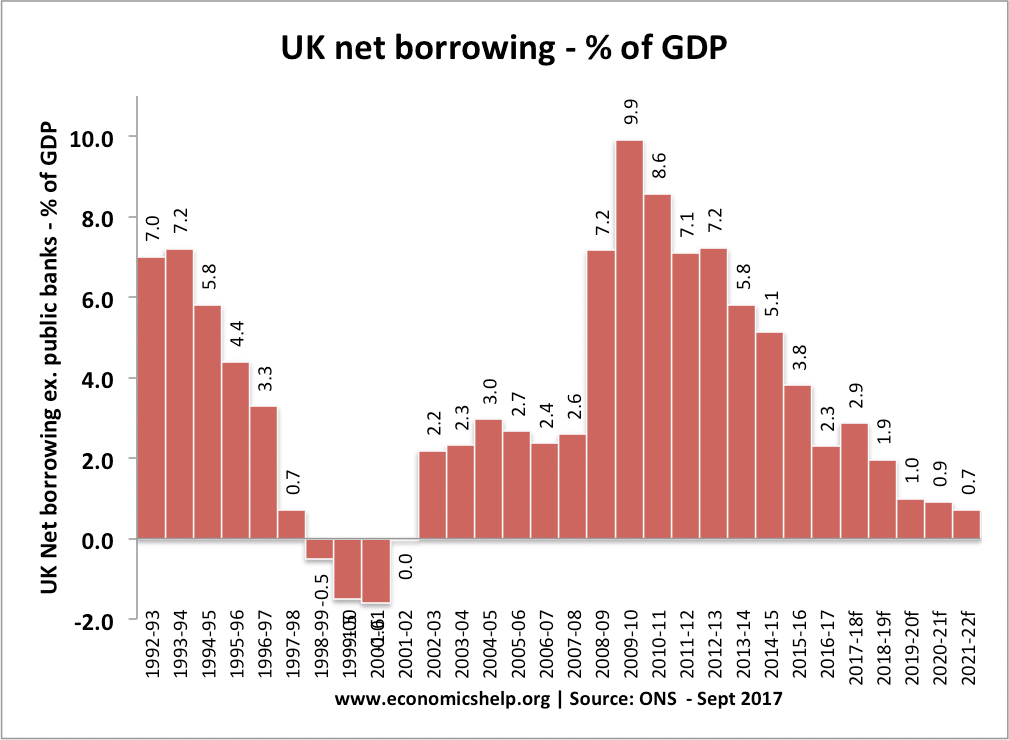

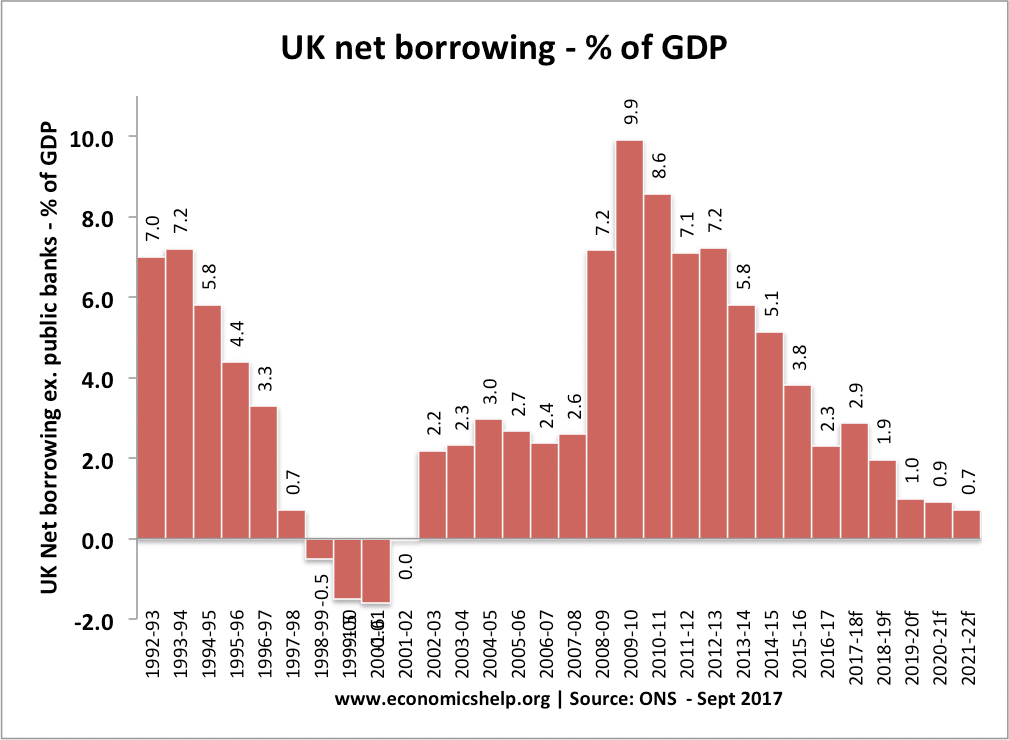

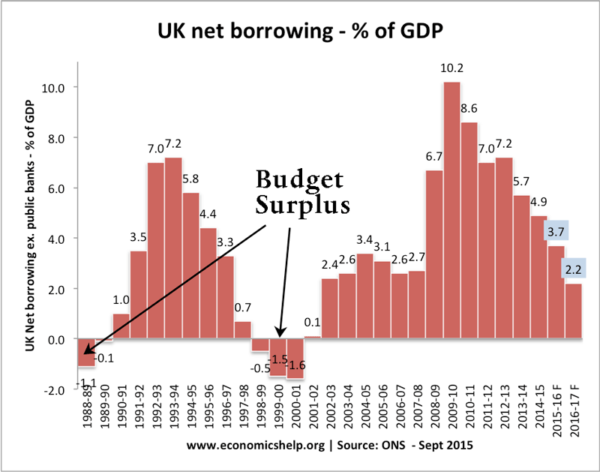

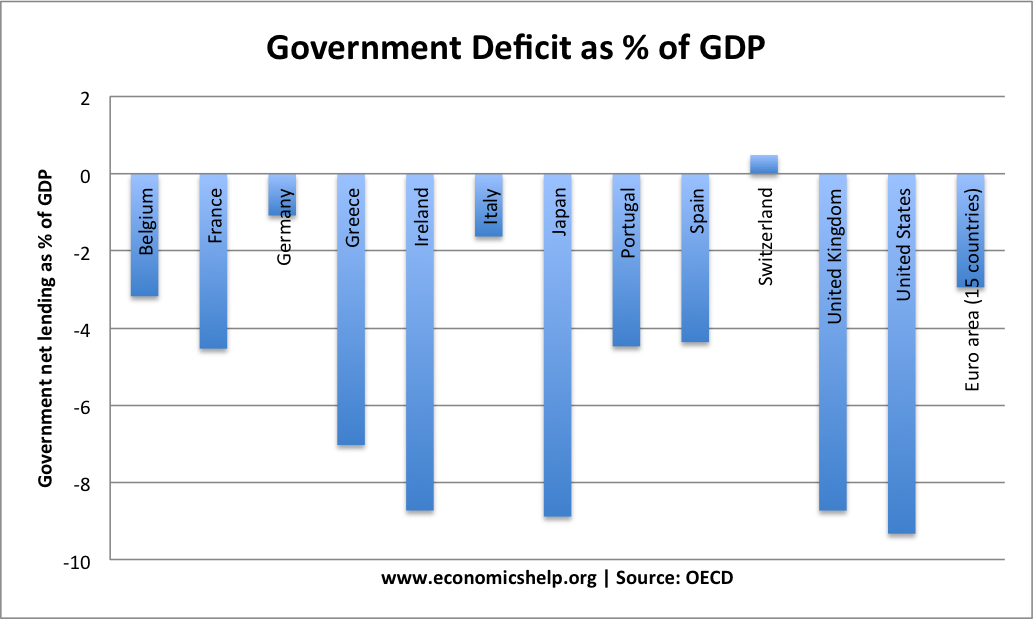

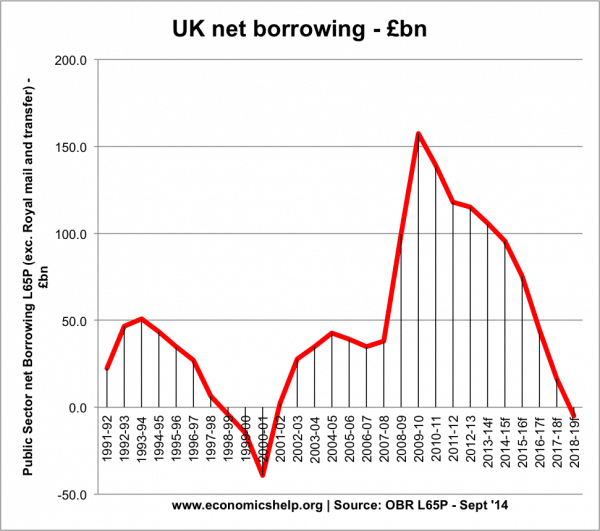

Social Security contributions are called taxes and Social Security benefits are called expenditures. Government budget deficit in 2011 was approximately 10 of GDP 86 of GDP of which was federal offsetting a foreign financial surplus of 4 of GDP and a private-sector surplus of 6 of GDP. For example the national debt of the United States is estimated at 23 trillion as of 2020.

To spend more than tax revenues allow governments borrow money and run budget deficits which are financed by borrowing. Suppose government current year receipts and expenditure are given below. Accrued deficits form national debt.

A budget deficit is where the government spends more than it receives. For example the Bush tax cuts added 56 trillion to the national debt between 2001 and 2018. Reduce budget Expenditure- By reducing revenue expenditure government can cop with the fiscal deficit.

Federal budget deficit for the fiscal year 2020 which ended on September 30 was 313 trillion according to the Congressional Budget Office CBO. When public savings are negative the government is said to be running a budget deficit. 2 Financial journalist Martin Wolf argued that sudden shifts in the private sector from deficit to surplus forced the government balance into deficit and cited as example the US.

The government generally uses the term budget deficit when referring to spending rather than businesses or individuals. C is a description of non-programs of the government. Increase Revenue Receipts and finance budget deficit through disinvestment and recovery of loans.

A government deficit is the amount of money in the budget by which the spending done by the government surpasses the revenue earned by it. Take Social Security for example. The term is typically used to refer to government spending and national debt.

Revenue Receipts 800. For example in 2009 the UK lowered VAT in an effort to boost consumer spending hit by the great recession. This gives us a budget deficit of 1327 trillion 3796 trillion of expenditures minus 2469 trillion of total income.

X by 1000 this year and pays him 1500 in benefits ten years from now this years deficit falls by 1000 and the deficit. Government budget deficit in 2011 was approximately 10 GDP 86 GDP of which was federal offsetting a capital surplus of 4 GDP and a private sector surplus of 6 GDP. By definition a government budget deficit must exist so all three net to zero.

If it isnt then it creates debt. A deficit must be paid. The amount borrowed is added to the nations national debt.

If the government taxes Mr. To minimise the deficit or the gap between the expenses and the income the government may reduce a few expenditures and also increase. The term applies to governments although individuals companies and other organizations can run deficits.

1 The interest payments as per the government budget during a year are 130000 crores. Lets understand Primary Deficit with example. C Fiscal deficit is the sum of primary deficit and interest payment.

As the debt grows it increases the deficit. D All of these. 11 The national debt and the federal deficit are related because the national debt is the accumulation of each years deficit.

B is a document of the economic policy of the government. A government budget is an annual financial statement which outlines the estimated government expenditure and expected government receipts or revenues for the forthcoming fiscal year.

Economic Effects Of A Budget Deficit Economics Help

Budget Explainer What Is A Structural Deficit And Why Does Australia Have One

Budget Deficit Definition 4 Causes And 4 Effects Boycewire

Policies To Reduce A Budget Deficit Economics Help

How Important Is The Budget Deficit Economics Help

Government Budget Deficits And Economic Growth Econofact

How Important Is The Budget Deficit Economics Help

Fiscal Deficit Meaning Formula Step By Step Examples Calculation

How Government Borrowing Affects Private Saving Openstax Macroeconomics 2e

Government Spending Macroeconomics

Budget Deficit Definition 4 Causes And 4 Effects Boycewire

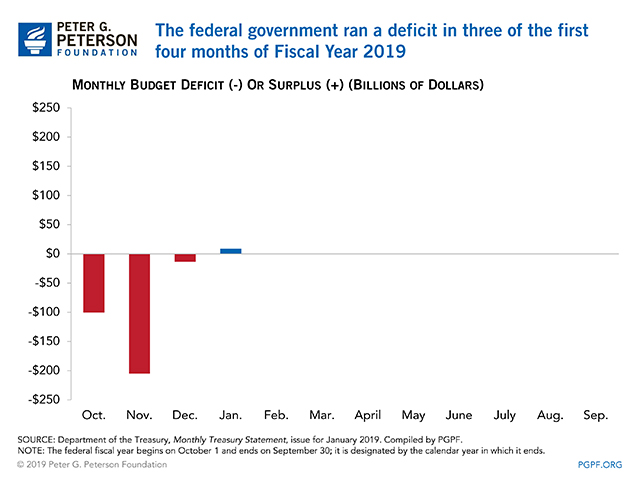

Federal Deficit And Debt January 2019

Budget Deficit Formula Examples Calculate Budget Deficit Of Us

Budget Surplus Definition Details And Quiz Business Terms

Effects Of A Budget Surplus Economics Help

Fiscal Deficit Meaning Formula Step By Step Examples Calculation

Federal Budgets And National Debt Macroeconomics

Budget Deficit Definition 4 Causes And 4 Effects Boycewire

Post a Comment for "Example Of Government Budget Deficit"